Mortgage investments becoming a more mainstream investment option for individual and institutional investors alike. Making money on debt never gets old but keeps evolving into many intricate vessels. Investing into a MIC can bring potential high-income opportunities. However, MICs have their risks too.

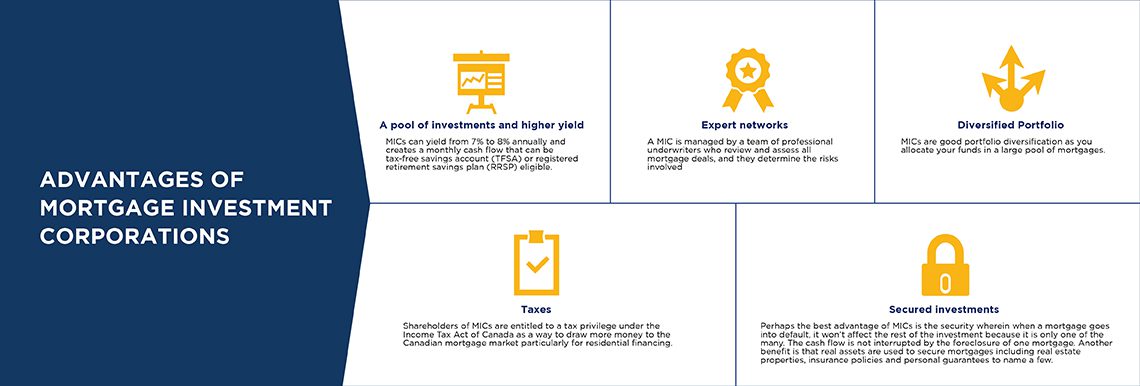

Advantages of Mortgage Investment Corporations

A MIC manages a diversified pool of mortgages from various investors and earns from the ongoing interest payments. Often, MICs are merely sought for their diversification element but there are numerous other benefits as well. These include:

- A pool of investments and higher yield – MICs can yield anywhere from 5% to over 10% annually and creates a monthly cash flow that can be tax-free savings account (TFSA) or registered retirement savings plan (RRSP) eligible.

- Expert networks – A MIC is managed by a team of professional underwriters who review and assess all mortgage deals, and they determine the risks involved

- Diversified Portfolio – MICs provide for portfolio diversification as you allocate your funds into a large pool of mortgages.

- Taxes – Shareholders of MICs are entitled to a tax privilege under the Income Tax Act of Canada as a way to draw more money to the Canadian mortgage market particularly for residential financing.

- Secured investments – Perhaps the best advantage of MICs is the security wherein when a mortgage goes into default, it most likely will have a minimal effect on the investment because it is only one of the many. The cash flow is not interrupted by the foreclosure of one mortgage.

All investments carry risks, and not all MICs are the same or equal in function. Here are some risks to consider when investing in a MIC:

- Credit Quality – MICs perform a thorough background check on the borrower although they impose lighter rules compared to traditional bank mortgages. This standard is to ensure that the leases will be paid according to the agreement.

- Liquidity Mismatch – MICs can be prone to liquidity mismatch when investors are in a hurry for an exit. This situation can only happen when the MICs do not have sufficient funds on hand to pay off their shareholders.

- Fluctuations – The fluctuating housing prices may affect the value of the properties used as collateral thus creating a negative impact on MICs. Some MICs might fail to recover the funding required to secure the mortgage.

- High Management Fee – Investors pay a management fee to a MIC for growing their money and mitigating risks.

This highlights the need to partner with a reputable MIC that has a proven track record of returns and responsible management.

What Investors Should Consider

A successful MIC focuses more on risk management, a strong management team, and high-quality assets. Yields will be enhanced over the long-term when all these qualities are strengthened and maintained.

Investors should not be impulsive in their search for portfolio diversification. Always study the nature and state of the housing market where the MICs are concentrated. Toronto and Vancouver are still the top choices in spite of the current changes in policies.

When looking for MICs, consider minimizing the benefit of tax mitigation where holdings can be provided in registered savings plans, including, RRSP, RDSP, TFSA, RESP, and RRIF.

You don’t make money on your shares appreciation, but instead, you earn a dividend that pays out every month or depending on the corporation’s rules (some pay quarterly or yearly). As you might have guessed, dividends increase with the increase in your shareholdings.

MICs are Effective Investments

Hunting for yield comes with an element of risk, and so investors must be well-prepared before delving into any MIC. Taking into consideration all the risks and benefits of mortgage investments. With all that in mind, they are a compelling investment vehicle.

Do not hastily jump into any MIC investment, instead, assess your risk and reward profile and align those with a set of investment goals. Stick with your goals regardless of the current market conditions by making sure that your finances are at minimum risk. Ask a specialist for more professional advice.