Mortgage Broker Vs. Bank

Mortgage brokers are real estate experts acting as middlemen for borrowers and investors. They arrange convenient house financing options for mortgage loan borrowers and supervise the overall mortgage process such as gathering requirements and checking the financial standing of the home buyer. The broker then submits the documents for underwriting. Their role is massive when it comes to ensuring that all transactions are valid in order for the loans to be approved.

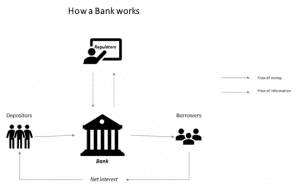

On the other hand, banks, also known as traditional financial institutions, are repositories of money that have become the preferred place to deposit and invest money over the years. Moreover, with the onset of technology, banking has also become dramatically convenient.

The main goal of banks is to increase the net profit of their investors and shareholders. Banks ensure that the funds of its depositors are safe and secure. By doing so, they are able to make money in the form of interest and selling loans and debt securities. They also pay what is due to investors and depositors by disbursing gains on the checking, savings, and time-deposit accounts of its depositors and investors.

Like others, banks have financial obligations to other institutions. These institutions include insurance companies, the federal reserve, and other independent investors that offer short-term borrowings to banks.

Banks source out their loanable funds from their shareholders’ deposits and equity. The latter is a large part of the bank’s capital and includes common stock, preferred stock, and retained earnings. A shareholder’s account also comprises of treasury stocks, reserve stocks, and stock options.

How Mortgages Work

Using their network of lenders and investors, mortgage brokers get in touch with banks, credit unions, MICs, secondary market investors and more to find options for its borrowers. After evaluating the options, the borrower then signs a mortgage agreement wherein they pay monthly amortization subject to prevailing interest rates. The cost of the mortgage (interest rate) is the profit gained by the investors.

At maturity, the mortgage ends and will either need to be paid in full, renewed or re-financed. Failure to pay the loan leads to the foreclosure of the property that was used as collateral, and the investor then takes possession of it.

Like banks, brokers have a source of funds that came from lenders who are either individual investors or part of a large group like a mortgage investment corporation or MIC.

Mortgage brokers do not necessarily lend money to borrowers. They only qualify borrowers and ensure that they have an excellent capacity to pay the loan.

How Much Do They Charge You?

When comparing a mortgage broker vs. a bank, one notable difference between the two is the cost of the loan or the interest rates.

Mortgage Broker

When dealing with a mortgage broker, the interest rates depend on the source of funds. Mortgage brokers do not charge the borrowers for their services. Instead, the industry practice is that they receive monthly commissions from lenders.

According to Loans Canada, mortgage rates under private lenders differ depending on various factors such as the type of property, the borrower’s capacity, market trends, and economic situations. Interest rates often range from 10 to 18%, which is a bit higher than what a conventional mortgage offers.

Banks

Banks are well known for charging borrowers and even depositors fees. Aside from prevailing industry interest rates, banks charge fees for almost every transaction.

Standard Bank Fees

- Monthly Account Fees. Account fees cover maintenance and administrative charges paid on a monthly scheme.

- Minimum Balance Requirement. This prevents penalties that come with zeroing out a bank account.

- Insufficient Fund Fees. Charges apply when there is not enough money when a transaction (e.g. check deposit) occurs.

- Other Transactional Fees

Mortgage Broker Vs. Bank: Which Is Better?

To determine which loan provider is better for you, you need to research the financial capacity and tolerance for risk of the institutions you are considering to transact with. Seek relevant information from industry experts, mortgage professionals, and bank executives before pursuing a loan. And lastly, bear in mind that what works for others may not necessarily suit your specific needs.

At CMI, it is our role to provide you with all the necessary details about mortgages. Let us know how we can help you with your needs.