Edmonton, the capital of Alberta, is experiencing improvements in its overall economic condition, which is expected to impact the city’s housing market in 2018.

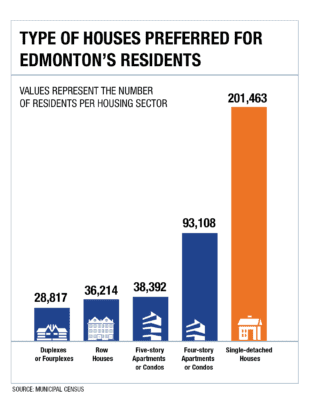

According to the municipal census, many of the residents prefer to dwell in single-detached houses (201,463 residents) and four-story apartments or condos (93,108 residents). Moreover, 36,214 residents prefer to live in row houses; 38,392 residents choose to live in five-story apartments or condos; and, 28,817 like to live in duplexes or fourplexes.

For the past couple of years, there is a noticeable slowdown in housing starts in the city’s single-detached and apartment sectors. Housing starts for single-detached homes decreased from 5,683 units in 2015 to 4,335 units in 2016. For multiples, the number of units decreased to 5,701 units last 2016 from 11,367 in 2015. However, it is forecasted that housing starts for both single-detached homes and multiples will increase in 2017 at 4,800 to 5,800 units and 5,400 to 7,800 units, respectively.

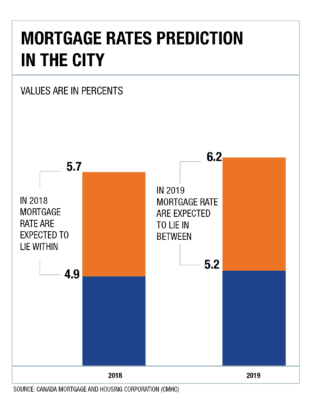

Mortgage rates in the city are gradually rising. According to the five-year mortgage prediction made by the Canada Mortgage and Housing Corporation (CMHC), Edmonton’s mortgage rates are expected to lie within the 4.9%-5.7% range in 2018 and between 5.2% and 6.2% by 2019.