How MICs Source and Adjudicate Loans and What Happens When There Is a Default

Mortgage Investment Corporations, or MICs, represent one of the fastest-growing alternative assets in Canada. As more investors turn to MICs, understanding the lending and adjudication processes becomes increasingly important. This understanding can help investors gauge the risk management and due diligence practices of leading MIC providers.

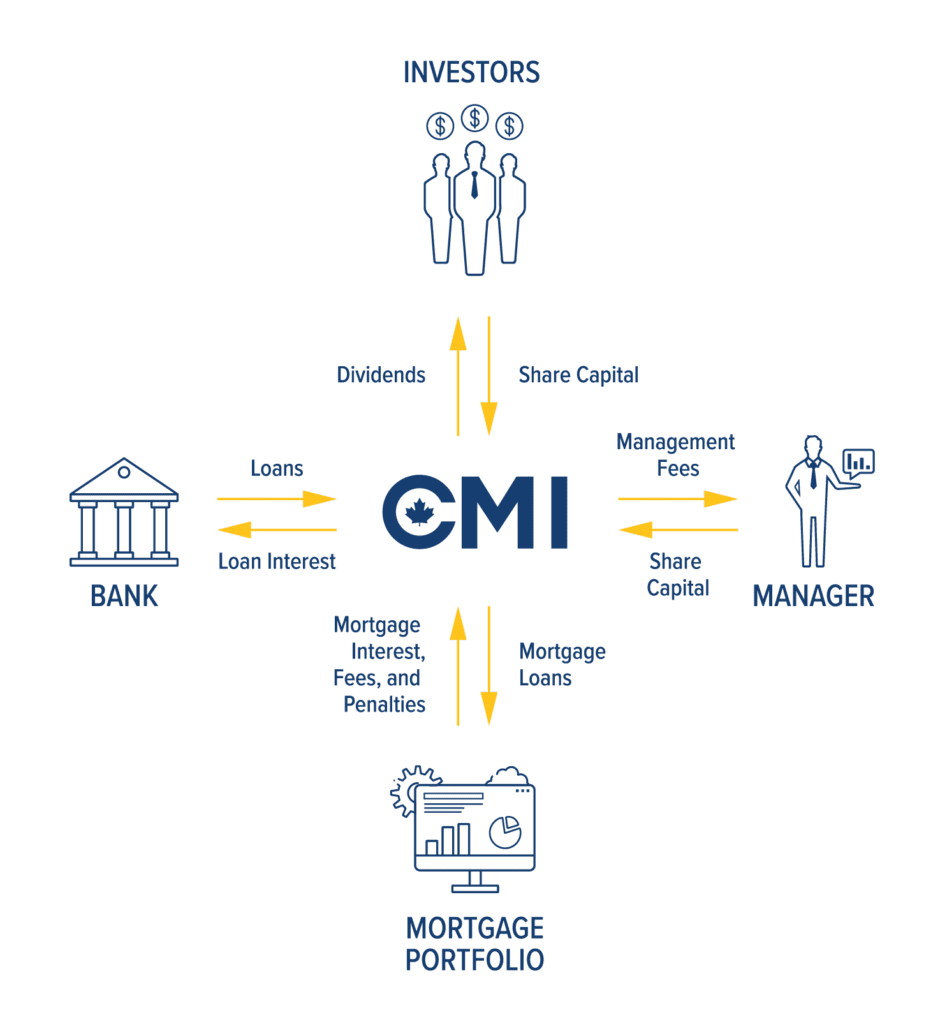

Mortgage Investment Corporations provide investors with direct exposure to the real estate market through a pool of carefully selected mortgages. A MIC is responsible for all aspects of the mortgage investing process, from origination to adjudication, including daily management.

The adjudication process is especially important, as it represents the criteria by which a borrower is judged. It involves verifying and analyzing a borrower’s information, such as income, assets, other debts, and repayment history, to ensure that the loan application meets the MIC’s risk management and lending standards. It is during the adjudication process that a final decision on a mortgage application is made.

In addition to verifying income, assets, and debt to determine the borrower’s ability to repay their loan, the due diligence process involves appraising the property and evaluating potential risk exposure to investors. After all, investors who deposit money into a MIC are doing so to earn a return on investment based on specific yield targets. That’s why leading MICs analyze the yield potential of individual mortgages to determine whether they align with their investment objectives.

In the case of CMI MIC Funds, our flagship CMI MIC Balanced Portfolio Fund targets a net annual yield of between 8% and 9%. Year after year, we have met this target thanks to our industry-leading risk management and due diligence practices.

Once mortgages are sourced and funded, the MIC’s administrator manages the loans and reassess them at maturity for renewal. Upon discharge, the MIC’s accounting team ensures that all fees and outstanding expenses have been paid by the borrower. Renewals and discharges usually begin 60 days before a mortgage reaches its maturity date.

In rare circumstances, Mortgage Investment Corporations must contend with unexpected volatility, such as fluctuations in real estate markets or an increase in late or missed payments. Experienced MIC managers are fully equipped to deal with these circumstances without adversely affecting portfolio returns.

CMI MIC Funds’ rigorous qualification process enables us to manage mortgage quality at the very onset of the investment process, minimizing the potential for repayment issues within the loan portfolio over the term of each mortgage. Still, returned and late payments cannot be proactively managed 100 per cent of the time. We employ an expert team of collectors, equipped with game-changing technology, to recoup the vast majority of missed payments.

In cases where a repayment issue remains unresolved, we engage our recovery team to move ahead with a monitored repayment program, and if necessary, active enforcement and liquidation of the underlying property. From legal enforcement through to possession, listing, and sale, CMI Mortgage Services, as part of CMI Financial Group, fully manages each step of the process.

It should be noted that experienced MICs typically have a default rate of between 1% and 2%. At CMI, this rate is typically below 1%. Sustainable, well-managed portfolios with a strong, long-term track record of distribution and diverse holdings are in a better position to mitigate risk.

CMI Mortgage Services, as part of CMI Financial Group, is one of Canada’s largest and most trusted MIC managers, having funded more than $500 million in loans across the country. Our MIC Family of Funds aligns with various risk profiles, investment objectives, and time horizons. We invest in mortgage markets across the country, allowing us to lend anywhere in Canada. To learn more about our investment process, contact us today.

What’s Next?

Contact us by filling out the form below for more information about our MIC funds.